It was a great week for the sugar futures market in NY with prices going up six dollars per ton on average for the two remaining maturities for 2015/2016, and 4.50 and 3.80 dollars per ton respectively for the two next harvests. More important than the sugar price hike in NY is the fact that the values reached nearly 1,000 real per ton (NY at 11.27 cents per pound and real at 3.8480). That had not happened in three years or, to be more exact it happened on 10/9/2012, when NY and the dollar were at 21.47 and 2.0364, respectively.

The dollar upward curve, following the flow of the messed-up political situation in Brazil, makes it possible for the mills to set their prices both for the 2016/2017 harvest and for the next one. It is time to take advantage of the opportunities. I believe the best strategy right now is to lock the exchange rate along the curve (via NDF), and purchase a sugar put option at a compatible exercise price at the budget value by the mill or at the cost of production plus financial costs. If NY goes up, the purchased put option is dropped and the company can follow an eventual high flow the market might have. The locked dollars, however, are limited to the notional value of the exercise price of the put option and need to be adjusted.

As for the fundamentals, China and Thailand, with a smaller harvest than expected and the Center-South with fixations just about complete for October/2015, have contributed to the narrowing of the October/2015-March/2016 spread to 94 points (the same one that traded at 160 points). The funds reduced the short positions to just 60,000 lots. The reduction of almost 30,000 lots (from Tuesday to Tuesday) with the market reacting only 70 points gives an idea of the magnitude of the fixation, which was waiting on better prices, and were counterpoints to the funds short liquidation. The market might interpret this small price movement vis-à-vis the huge reduction in the position of the funds as bearish.

It is difficult to analyze the market in the very short term, since exogenous factors come into the equation and can distort reality. In the long term, however, when we can outline realistic scenarios and elaborate on the effects they will have on the supply and demand and, therefore, on prices, there is a safer decision-making process. And it is part of this scenario ahead of us I would like to share with you.

Fuel consumption growth in Brazil over the last ten years has happened in a robust way. The yearly growth composite rate is 7.8%, that is, fuel consumption in the country doubles every 9 years. There is a correlation with the GDP’s growth, which in fact enhances the consumption growth, but it is not 100% dependent on it. The GDP’s estimated fall by 2.3%, this year does not mean there will be a decrease in consumption too. Actually, the GDP’s fall affects auto sales – we will obviously sell less – but we will continue to grow as far as the fleet goes. In addition, each new vehicle in the streets is an energy-consuming being, which consumes close to 1,400 liters of fuel a year.

Fuel consumption growth in Brazil over the last ten years has happened in a robust way. The yearly growth composite rate is 7.8%, that is, fuel consumption in the country doubles every 9 years. There is a correlation with the GDP’s growth, which in fact enhances the consumption growth, but it is not 100% dependent on it. The GDP’s estimated fall by 2.3%, this year does not mean there will be a decrease in consumption too. Actually, the GDP’s fall affects auto sales – we will obviously sell less – but we will continue to grow as far as the fleet goes. In addition, each new vehicle in the streets is an energy-consuming being, which consumes close to 1,400 liters of fuel a year.

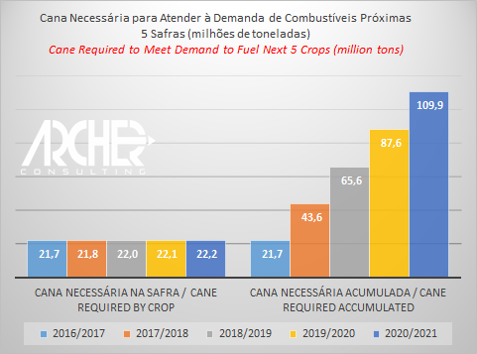

The fleet of light vehicles will keep growing – with less intensity but growing. Within five years, the fuel market will go from the current 58.9 billion liters (according the last data released by ANP) to 76.2 billion liters in 2020/2021. That is, if this increase in consumption has to be supplied in today’s same proportion, it will take an addition of no less than 110 million tons to the sugarcane production for the 2020/2021 harvest.

Besides, not only the domestic sugar market but also the foreign market grows. Even though we are extremely conservative on the world’s consumption growth, which most trading companies place at 2.1% a year, but which Archer has set at 1.76% a year, we would need another 60 million tons of sugarcane, without gaining 1/100 share of the market Brazil holds today.

To put it shortly, in 2020/2021 we will need 170 million tons of additional sugarcane on top of what we produce today. That is, even using the idle capacity the current industrial park has, we need to build at least 30 mills with a crushing capacity of 5 million tons of sugarcane. It will be hard to convince investors to put their money into such a huge venture and with the lack of transparency, this tactless government deals with our country’s energy issue.

Some will say that in 2017 Europe will flood the foreign market with sugar. The fact is today we do not know Brazil will be able to produce enough to meet the normal conditions of the market.

The solution to this equation will have to come from the combination of some these factors: a) decrease in demand for fuel via price; b) more gas import; c) corn ethanol import. If we had a government with a little competence and resourcefulness to make simple synapses, we would be halfway along the way to the solution. However, we have a dyslexic president who cannot think and speak at the same time without embarrassing those watching her make disconnected speeches and who don’t belong to the trained audience. All it would take is to introduce a transparency policy for fuel pricing which allowed the market to try to protect itself ahead of time, just like the sector has enough skills to think about locking the sugar price for the next two harvests. Despite these difficulties, the scenario ahead is excessively constructive for the sugar price in NY.

Marcos Masagão, analyst with Future Analysis Consultoria (www.futureanalysis.com.br) does some interesting work covering several financial assets and commodities, among which sugar. Marcos reports that the average price of short positions on the part of the funds against October/2015 is at 14.09 cents per pound. It would be approximately close to this level the funds would start to act, that is, repurchase their short positions. We are still too far from that. Nevertheless, according to the analyst, the great resistance point on the part of the funds is at 11.63 cents per pound, which the market tested this Friday and could not go over. There are exciting days ahead until October’s sugar futures contract expires on September 30. Interestingly enough based on Friday’s closing at 11.27 cents per pound and taking into account that the funds are 60,000 lots short sold, if their average selling point was 14.09 cents per pound, there is an unrealized profit of almost 200 million dollars.

Monday is a holiday in the USA (Labor Day) and in Brazil (Independence Day).

Wish you all a great weekend and some deserved long rest.

Arnaldo Luiz Corrêa