The sugar futures market in NY closed the week at a 39-point high (8.60 dollars per ton) in the first trading month, October/2015, and milder positive variations in the following months. The October/2015-March/2016 spread narrowed to 79 points showing that those who held or still hold short positions against October/2015 are buying them back maybe fearing there will be less available sugar than previously predicted on the short term. The mills that rolled over their selling hedges from October to March to take advantage of the outrageous implicit carry rate might change their positions back if the spread trades at around 60-65 points. September will be an interesting month.

The dollar hike against the real has encouraged a lot of companies to increase their selling hedges for 2016/2017 and even for 2017/2018 taking advantage of the exchange curve. Since NY is also slipping away from the real mainly because of the fundamentalist scenario of the sugar (more constructive according to what we discussed here last week), it has made more sense to buy puts which will guarantee minimum returns than to sell futures which can still go up due to the fundamentals. So, the mills have time to set the price later on when its level suits them and the pressure on NY over the next maturities decreases. The in-the-money puts along the price curve for the 2016/2017 crop (May/July/October/March) have already come to 16,000 lots, that is, almost 1 million tons of sugar equivalent.

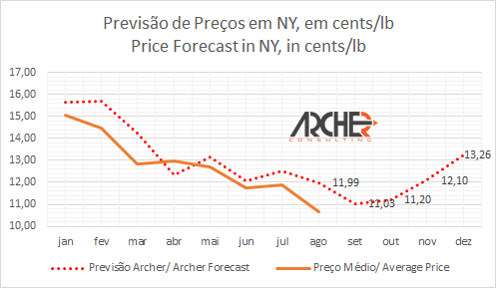

The price forecast model for the next months shows a peak in December/2015 (March 2016) of 13.26 cents per pound – everything else unchanged. Models fail, although the correlation of this model is above 0.8500.

We are not taking into account some factors, for instance, the possibility of CIDE (Contribution for Intervention in the Economic Domain – Federal Tax) being introduced so that the government can alleviate its budgetary deficit. The forecast is that a CIDE of R$0.30 per liter gas will increase government revenue by R$10.5 billion. Today, the government collects R$56 billion in taxes on fuel. The gas price change will make ethanol even more competitive and should direct more sugarcane for fuel production and change mills’ planning for next year with sugar availability tending to decrease.

We are not taking into account some factors, for instance, the possibility of CIDE (Contribution for Intervention in the Economic Domain – Federal Tax) being introduced so that the government can alleviate its budgetary deficit. The forecast is that a CIDE of R$0.30 per liter gas will increase government revenue by R$10.5 billion. Today, the government collects R$56 billion in taxes on fuel. The gas price change will make ethanol even more competitive and should direct more sugarcane for fuel production and change mills’ planning for next year with sugar availability tending to decrease.

This is not a new issue, but it is impossible to keep quiet before such an incompetent government like the one we have today. Just this year, the irresponsible and irrational way Dilma has promptly led Brazil to the bottom, making the sugar-alcohol sector debt go up – according to Archer’s calculations – by R$14.6 billion (R$22.86 per ton of crushed sugarcane). Real devaluation reflects our president’s disregard for the economy and fiscal balance and the currency weakening represented, as commented here a few weeks ago, 84% of the reason for the sugar price fall in the futures exchange in NY, that is, revenue loss in dollars from sugar exports caused by the Brazilian currency fall adds up to about US$565 million in the first eight months of the year. Dilma should get a plaque for the great services done to the sector.

But we shouldn’t forget this president’s “love” goes back a long way. A meeting held in Brasilia in mid-2012 aimed at bringing the president closer to the productive sector and making her see the increase in fuel demand due to the growth of the light vehicle fleet – largely funded by easy credit – would sooner or later stumble over the operational inability the country had to increase oil production. There was a risk, as an expert in the area had alerted to at the time, of a fuel “blackout” in Brazil and so the urgent need to produce more ethanol had come. But for this to happen, there had to be fuel pricing transparency and clear rules in order for the Brazilian or foreign investors to feel safe and encouraged.

To Dilma, however, the sector should “make a sacrifice” and “give back a little” of what the country had given it. With her usual haughtiness and her Marxist-Leninist training – where making a profit is sinful – the president, who today holds a solitary digit of popularity, would pick on a businessman from the sector saying he had become very rich already. It is worth remembering that by that time Petrobras was already being ripped off by this gang, only they hadn’t been busted yet.

The worst cane field pests are not the sugarcane borers (Diatreasaccharalis) or the sugarcane “bicudo” (Sphenoforuslevis), but two other pests that destroy productive sectors, jobs, wealth, reputations, hopes and everything else that comes their way. They are called Luiz Inácio Lula da Silva and Dilma Roussef, and the only way to eradicate the evil they have been causing to the sector and to Brazil as a whole is through voting.

I borrow the sentence of the friend and guru from a generation of economists, Professor José Roberto Mendonça de Barros, “Never before in this country have things been so messed up and uncertain. The government runs the risk of hitting a wall”.

You all have a great weekend.

Arnaldo Luiz Corrêa